You can expect it to drop 20% or more every few years, and 40% or more once a decade. So money you want to keep safer — especially if you need it in the next three to five years — should be kept in cash or bonds. Consider a target retirement fund, which provides a prudent asset allocation based on your retirement date and gets gradually more conservative as the date approaches. The old rule of thumb used to be that you could fund a stable retirement by saving 10% of household income annually.

Getting Started

For those ineligible for a Roth IRA, consider a traditional IRA. As with your 401(k), this is funded with pretax dollars, and the assets within it grow tax-deferred. Early midlife tends to bring a number of financial strains, including mortgages, student loans, insurance premiums, and credit card debt. However, it’s critical to continue saving at this stage of retirement planning. The combination of earning more money and the time you still have to invest and earn interest makes these years some of the best for aggressive savings. Keep in mind that your risk tolerance may change as you age and stop earning a paycheck.

Eliminate All Debt

Contribute all you can to lower your taxes, get matched funds from your company, and benefit from automatic deductions. The compound interest and tax deferrals will accumulate quickly over time. Find out how much you have to contribute to get maximum employer participation and how long you have to keep money there to avoid penalties. Some experts recommend that you sock away three months of living expenses, while others suggest you save enough for at least a year.

Financial independence

Here’s a primer on 20 of the most common retirement terms, outlining what they mean and why they’re important. There are no initial costs for us to tailor a retirement plan for you. Some of our financial advisors do fee-based planning, but they’ll let you know that up front. Talk to one of our financial advisors about getting your retirement plan.

This is a rule of thumb, though many people reach retirement with a big nest egg and still can keep a good portion of their assets in stocks. Just make sure that any money you need for day-to-day living is not subject to market ups and downs. One is that the contribution limit is much higher than it is with an IRA. Workers who are younger than age 50 can contribute a maximum of $20,500 to a 401(k) in 2022, up from $19,500 in 2021, or $26,000 if you’re over 50. Employers are also allowed to match contributions — though the percentage of contributions they match and the amount matched per employee dollar does vary. Using Vanguard Group-managed retirement plans as an example, in 2019 it reported an average employee contribution rate of 7.0%, and average employer contribution rate of 3.7%.

It’s a good idea to talk to a professional before making any outside-the-box investment decisions. Everyone dreams of the day they can finally say goodbye to the workforce and retire. Sure, you may have Social Security benefits, but that may not be enough, especially if you’re used to a certain lifestyle. Setting aside money now means you’ll have less to worry about later. Retirement planning is such an important part of your financial well-being.

Retirement Planning Calculator

If you don’t properly plan for health-related expenses, especially unexpected ones, they can decimate your savings. Some employer-sponsored plans offer a Roth option to set aside after-tax retirement contributions. You are limited to the same annual limit, but there are no income limitations as with a Roth IRA.

The information provided here is for general informational purposes only and is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Where specific advice is necessary or appropriate, consult with a qualified tax advisor, CPA, financial planner or investment manager. Once the plan is finalized, the following are the documents needed to start investing in mutual funds with Scripbox.

Financial advisor

Consider our Rule Your Retirement service, which features a monthly newsletter, solid asset allocation and investing advice, and professionally staffed discussion boards. Furthermore, Millennial Roth IRA accounts with a contribution increased by 5.8% year-to-date. Your employer can help you save for retirement with these options. The other accounts are offered by your employer (or yourself, if you’re self-employed). These include 401(k)s, 403(b)s, and the Thrift Savings Plan (TSP). Furthermore, your employer might sweeten the deal by matching your contributions to your account.

Our Planner

Also, they can invest small amounts regularly to reach their target amount. Start by paying off the bad debts (highest interest rates) as quickly as possible. Focus as much as you can on knocking out high-interest debts quickly and allow your lower-interest debts to be paid off at minimum payments. Avoid obtaining future bad debt by refusing to go into debt for consumer goods. High-interest debts with low value (like credit cards), do not give you a beneficial asset but will cost you in fees and interest. Instead, look for good debt (like real estate investments or educational investments) that maintains a low-interest rate and should benefit you financially in the long run.

Medicare and Health Benefits

That way, you can make the most of your retirement while still enjoying your life today. With a traditional account you pay the tax bill in retirement. Money inside a traditional 401(k) or IRA is not taxed during the years it is invested. But no later than age 72 you must start making withdrawals from a traditional account, and every dollar withdrawn will be taxed as ordinary income. The hope is that your tax rate will be lower than it was when you contributed money. A lot of people like investing on their own, but when it comes to retirement savings it’s a good idea to work with a financial advisor who has a certified financial planning designation.

Take Advantage of Catch Up Contributions.

You may also want to consider talking to a professional, such as a financial planner or investment broker who can steer you in the right direction. That’s because your investments grow over time by earning interest. For those who have maxed out tax-incentivized retirement savings options, consider other forms of investment to supplement your retirement savings. Certificates of deposit (CDs), blue-chip stocks, or certain real estate investments (like a vacation home that you rent out) may be reasonably safe ways to add to your nest egg.

Healthcare Costs in Retirement: Managing Medical Expenses

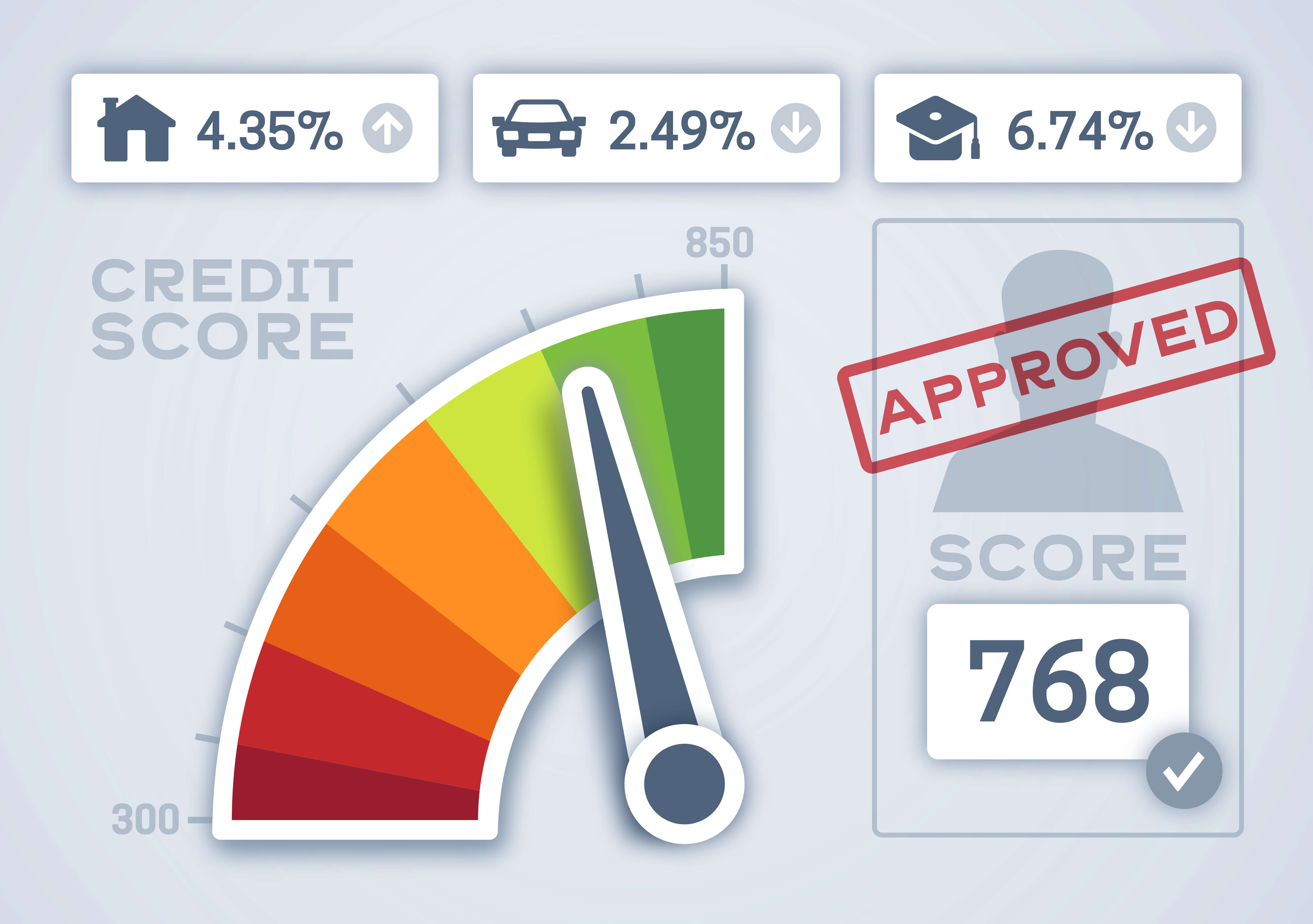

Knowing the facts about what’s important to lenders is the first step to getting the best rate on a loan. We’re here to lend you some tips on what lenders look for before you borrow money. It is also worth trying to get pre-approved or a good indication of approval by using an online broker like Money Saving Expert, Money Supermarket, or Compare The Market. If your goal is to build your credit score, there are much better ways to do it. Klarna’s financing is for longer term borrowing, for example, periods between 6 – 36 months. When you apply, you are really only presented with one offer, which is unique to you.

Credit scoring models were first utilized in the credit industry more than 50 years ago. They were developed as a way to determine a repeatable, workable methodology in administering and underwriting credit debt, residential mortgages, credit cards and indirect and direct consumer installment loans. Industry-specific scores are optimized for specific credit products like auto loans or credit cards. FICO uses the same base of information available in its “classic” scores, but fine-tunes the data based on industry-specific risk behavior. CE Credit Score — The creator of this scoring model (CE Analytics) was unhappy with the current model of customers paying for their credit score and companies hiding how their credit scores were revealed.

What is a good credit score for finance?

We provide a score from between 0-999 and consider a 'good' score to be anywhere between 881 and 960, with 'fair' or average between 721 and 880. Before you apply for credit, it's a really good idea to check your free Experian Credit Score, so you can make more informed choices when it comes to applying for credit.

Participants of the Mintel survey have very similar educational attainments and income to other nationwide representative household surveys, such as the Survey of Consumer Finances. The Mintel sample, however, has a somewhat higher average age and greater share of white consumers. You can check your credit reports from all three bureaus for free—at AnnualCreditReport.com. While the name implies annual access, consumers will have weekly access to their reports through the end of 2023 thanks to changes made early in the pandemic. Credit repair companies work by analyzing your credit reports for mistakes, inaccuracies, and negative items that are hurting your credit score.

FHA loan: 580

Because credit reports contain personal information consumers are advised to monitor their credit regularly. Understanding your personal finances is complex, as there are so many factors that can influence your creditworthiness in the eyes of lenders. As explored above, it’s important to be aware of the different things that can influence your credit score, so you can take the necessary steps before applying for credit in the near future. So, if you’re planning to close a bank account, it’s really important to do so responsibly. You should first contact the bank and ensure you don’t have a negative balance. It’s also vital to consider any outstanding checks or pending transactions that are due to leave your account after you’ve closed it.

CHOOSING A PATH TO YOUR BMW

Using Klarna can also negatively affect your credit score if you apply to use financing and if you take out a payment holiday. These could impact your ability to take out a new credit card or even a mortgage. Knowing your credit report and credit score is crucial because having a bad credit score can seriously impact your personal finances. You can manage your credit score and take advantage of more financial opportunities as you improve your credit score by taking the time to learn how credit scores function and what causes a bad credit score. Don’t be deterred if you feel like your credit is lower than you’d like it to be right now.

Online investing

Because consumers rely on us to provide objective and accurate information, we created a comprehensive rating system to formulate our rankings of the best auto loan companies. We collected data on dozens of loan providers to grade the companies on a wide range of ranking factors. After 300 hours of research, the end result was an overall rating for each provider, with the companies that scored the most points topping the list. If you have just one credit card, or one type of credit, try opening a different kind of account for a modest bump in your FICO score. For example, you could finance a small purchase, such as a new refrigerator or a new couch.

For federal agencies

As a legitimate credit repair company, Sky Blue Credit only helps improve your credit score by challenging incorrect or misleading items on your report. This means that it can’t repair credit due to actually damaging credit behaviors, such as late payments or multiple hard pulls within a short time. While it may be tempting to apply to various credit cards it is important to remember that each application causes a “hard inquiry” which can reduce your credit score.

Credit bureaus are national entities that collect data from financial institutions on individuals who use their services, such as credit cards or bank services. That information is then used to determine their credit worthiness (or score). Your credit score is a short representation of your creditworthiness – it tells the story of how responsible you are as a borrower and can help you earn the trust of lenders. Lenders use this number to gauge your chances of repaying a loan in good time. A good credit score makes it easier to get personal or business loans at affordable interest rates. There are no shortcuts when it comes to improving your credit score.

When some debt is better than no debt

However, keep in mind that lenders have their own FHA credit score requirements. If you have a credit score lower than 580, you may still be approved but you will need 10% of the home purchase price as a down payment. If you’re a business card holder for a much larger company, your use of the credit card isn’t likely to affect your credit score in the same way. Still, you should be mindful of how your company manages its credit card, as you don’t want their irresponsibility to have a negative impact on your credit score. TransUnion, Experian, and Equifax are the three main credit bureaus. The credit scoring models used by most auto lending institutions are FICO® Auto Score and Vantage.

How A Credit Score Is Calculated

This is the level at which you are likely to qualify for the best interest rates on loans. This includes new credit accounts, inquiries, and derogatory information such as late payments. Most of these tools to track and simulate your credit score are free through your bank, credit card or Credit Karma. You may have access to these tools now in your financial accounts, which can send you alerts on score changes, new inquiries and purchases. What Randawa finds most interesting, however, are credit score simulators that show how potential actions can affect your score.

Payment History: Are bills paid on time? Are there any missed payments?

Some companies will offer a 90-day money-back guarantee if they cannot remove misleading items from credit reports within 90 days. Others offer a broader money-back guarantee you can claim if you’re not satisfied with their service for any reason. The greatest credit repair companies will often offer several plans aimed at different needs. These plans have a monthly fee, but you can cancel your subscription at any time. We used several criteria to identify the best credit repair services on the market currently. Every financial situation is unique, so you’ll have specific requirements and expectations from your credit repair service.

Apply for a Credit Card

It’s likely that the action has led the credit repair business to improve its customer service, as evidenced by its high Trustpilot rating. What makes Lexington Law so appealing is that it has a 24/7 helpline that gives you access to advisors whenever you need them. The site also has an extensive knowledge base that helps you understand what goes into a credit report and how your actions affect your score. The plans have monthly fees ranging from most affordable for the Concord Standard to most expensive for the Premier Plus. The credit repair process starts with a free consultation, either by phone or via an online appointment.